How to prepare a cashiers check

A cashier's check is a check that is a drawn on a bank's funds rather than your own personal funds. It offers a secure way to pay in situations where a personal check is not appropriate, such as real estate transactions.

What makes a cashier's check different from a personal check is the guarantee. Anyone can write a personal check for any amount, but that doesn't mean the check is any good. Because cashier's checks are checks issued by banks, they represent a guarantee of existing funds. As with any check, fraud is possible, however with cashier's checks there are fewer opportunities. This version of How to Get a Cashier's Check was reviewed by Michael R. Lewis on January 1, Community Dashboard Random Article About Us Categories Recent Changes.

Write an Article Request a New Article Answer a Request More Ideas You cannot get a blank cashier's check. You must have a payee. A cashier's check has the payee information completed on the check itself.

Unlike a money order, on a cashier's check you can't write in the payee information yourself. It may be useful to take the payee to the bank with you, so that you have all the information you need.

On the check itself, be sure to give the first and last name of the payee as it appears on their identification. If you are not sure of this information, ask the payee. If your cashier's check is getting used to pay an organization and not an individual, be sure to find out how to complete the payee information according to the organization's guidelines.

Cashier's checks are a better option than a money order for larger payments, because money orders often have maximum limits, but there will be no maximum limit on a cashier's check amount. Find a large bank that issues cashier's checks to the general public, and bring cash funds, if you do not have a bank account. Determine the exact amount needed.

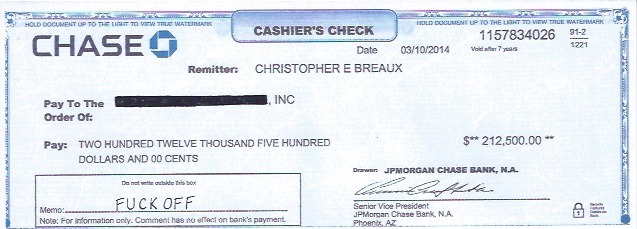

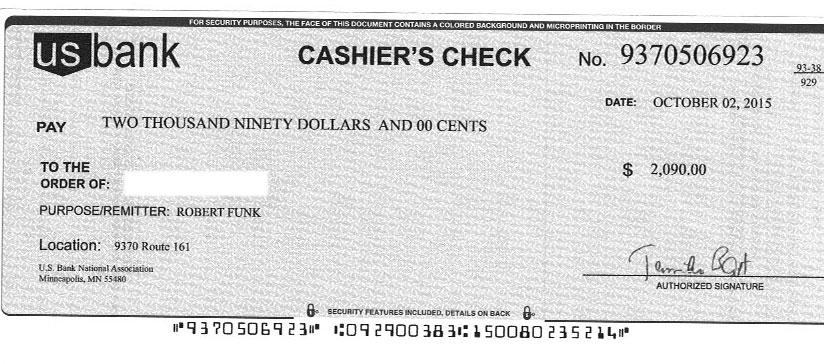

You need to know the exact amount before you get the check. In many cases, the amount is printed on to the check when you receive it from the bank teller. But in any case, the amount will be filled in by the cashier, so you will have to tell him exactly how much to put on it.

The cashier will sign the check after verifying you have the funds in your account or with you to cover the amount of the check.

Cashier's check - Wikipedia

Be ready with your identification. The bank you purchase your cashier's check from will require you to show identification. Banks guarantee a cashier's check with their own funds.

For this reason, they will ask to verify your identity, access your account, and ensure you have the money necessary to cover the check amount. Prepare the necessary funds. Deposit enough money into your account to cover the amount of the cashier's check.

If you are purchasing the check from a bank where you don't have an account, bring the amount in cash. You will have to pay a small fee to pay for the service the bank provides. If you are not a customer of the bank where you purchase the check, you may have to pay a higher fee typically some percentage of the check amount. Banks are not required to issue these checks to the general public. Some upper-level bank accounts may qualify for free cashier's check service.

Visit your chosen bank to purchase the check. Any bank can issue a cashier's check, but the best option for you will be the cheapest option. Check with your bank to find out if you qualify for any special pricing or fee waivers. Compare prices between different banks to get the best deal.

Give a tips for day trading penny stocks teller all the information you have prepared, and allow him to print the check for you.

A bank teller will prepare a cashier's check for you on the spot—you do not need an appointment. You will, however, have to meet face-to-face with a teller to get the check.

Pay for the check. The amount of the check you are purchasing plus the bank's fee will be debited from the account into which you deposited the funds.

Find out fee costs ahead optionshouse ira 100 free trades promotion time to ensure you have the cash to cover the full amount.

Get a receipt for your cashier's check. Make sure to how to prepare a cashiers check a receipt in case you lose or damage the check; unlike a personal check, you can't simply tear it up and write a new one. The receipt will have the check number and work at home fever bbb, allowing you to contact the bank in case you should lose the check for any reason. The bank has sophisticated ways of tracking your check, to be able to tell whether the check has been cashed or not.

Databases can be searched for the check number, and, if it is not found, this tells the bank that the check has not yet cleared.

How to Fill out a Cashier's Check: 15 Steps (with Pictures)

Simply present your receipt at the bank for an update about whether your check has been cashed by the payee. If the check never reaches its destination for any reason, the bank can cancel the original makes a lot of money thesaurus and resend payment. Check with the payee periodically in addition to the bank to see if the check has reached its destination.

Get proof of the cashed check. You can get proof of the check's having been cashed with a copy of the front and back of the check from the bank. A fee may be required for this service. In the event that the person who cashed the check is how to prepare a cashiers check the payee, the bank can get the money back and initiate criminal proceedings against the person who cashed the check illegally.

Lots of fraud is committed via cashier's checks, so keep a close eye on your cashier's check to be sure it has reached its destination using the tracking tools the bank has at its disposal.

Can the payee get the money as soon as they receive the cashiers check? The Payee on a Cashier's Check can receive immediate funds cash or deposit into a personal savings or checking account when cashing the check since the issuing bank has guaranteed payment. Not Helpful 0 Helpful 2. Do I need to sign a cashier's check?

A representative of the bank signs it. Not Helpful 0 Helpful 1. When mailing a cashier's check, do I need to register the check? The check is already registered with the issuing bank. It might be a good idea, however, to register or certify the letter when you mail it.

If I decide not to pay with a cashier's check, can I get the money back into my bank account? In most cases, you can simply endorse the check following the issuing bank's instructions and they will deposit funds back into your account or make a cash refund immediately. Not Helpful 1 Helpful 1. Can I buy a check and have it dated for a past date? The bank fills out that information, and it's not likely they would be willing to use a past date. Not Helpful 0 Helpful 0. Cashier's check with a deposit slip will be deposited into my account?

Do I need to write a description in the memo section on a cashier's check? That memo line is only for your convenience.

Can I get a cashier's check with a credit card? It's unlikely a bank would accept a credit card as payment. Is it cheaper to get a money order or a cashier's check? Money orders are typically cheaper, but each institution is free to set its own fee structure. How do I cash a cashier's check without a banking account of my own? That could be quite difficult.

It's likely a bank would ask you to open an account with them and deposit enough money to cover the check. That may seem unfair, but it's a fact of modern life. Getting a cashiers check from my bank with funds from another bank?

Answer this question Flag as Will my bank account number be on my receipt of my cashiers check? Does the name of the purchaser or the name of the issuing institution need to appear on the cashier's check?

Already answered Not a question Bad question Other.

How to Get a Cashier's Check: 10 Steps (with Pictures) - wikiHow

If this question or a similar one is answered twice in this section, please click here to let us know. Warnings Be wary of accepting cashier's checks in certain situations. Although they are generally viewed as secure, cashier's check fraud is a fairly common practice; a fraudulent cashier's check will clear your bank account several days before it is discovered to be bad, and you, not the charlatan, will be liable to repay the bank for the full amount. Edit Related wikiHows WH.

Checks and Checkbooks In other languages: Thanks to all authors for creating a page that has been readtimes. Did this article help you? Cookies make wikiHow better. By continuing to use our site, you agree to our cookie policy. About this wikiHow Expert Review By: Reader Success Stories Share yours!

TD Tonya Davis Jan 2. I would use it or recommend it to anyone else I know. More stories All reader stories Hide reader stories. Home About wikiHow Jobs Terms of Use RSS Site map Log In Mobile view. All text shared under a Creative Commons License. Help answer questions Start your very own article today.