Call put option butterfly

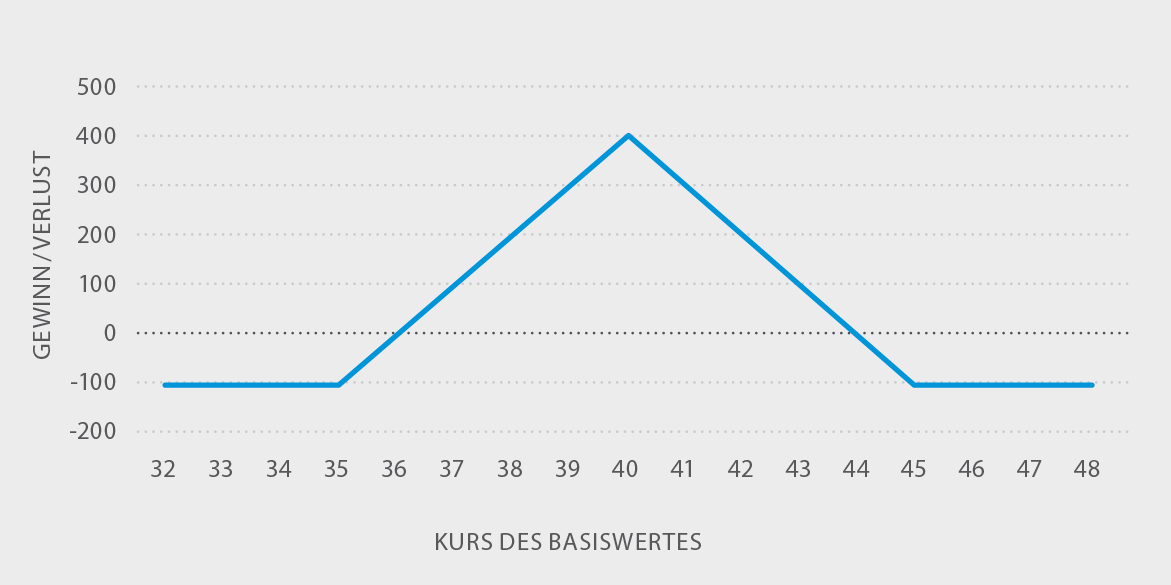

This spread is typically created using a ratio of 1 ITM option, 2 ATM options, 1 OTM option.

Options Trading Strategies - Butterfly Spread IntroductionThe distance between the short strike and long strike, less the debit paid. How to Calculate Breakeven s: Higher Long Option Strike - Debit Paid - Downside: At tastytrade, we tend to buy Call or Put Butterfly spreads to take advantage of the non-movement of an underlying stock.

This is a low probability trade, but we use this strategy when implied volatility is high, as the butterfly spread then trades cheaper.

The spread trades cheaper in this situation since the price of the In-The-Money option consists primarily of intrinsic value. Therefore selling the ATM options covers a higher percentage of the cost of purchasing both of the long options.

Long Call Butterfly Spread | Butterfly Spreads - The Options Playbook

When do we close Butterflies? Since achieving maximum profit on a Butterfly is highly unlikely, the profit target on this position is generally lower. When do we manage Butterflies? Long Butterfly spreads are low probability, low risk trades. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. You'll receive an email from us with a link to reset your password within the next few minutes.

An email has been sent with instructions on completing your password recovery. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Follow along as our experts navigate the markets, provide actionable trading insights, and teach you how to trade.

Applicable portions of the Terms of use on tastytrade. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment strategy is suitable for any person.

When does one sell a put option, and when does one sell a call option?

Trading securities can involve high risk and the loss of any funds invested. Investment information provided may not be appropriate for all investors, and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance.

Butterfly (options) - Wikipedia

Please read Characteristics and Risks of Standardized Options before deciding to invest in options. Trades for 7 days. Join Now Sign In Help Open A Tastyworks.

Home Watch Live Shows Learn Blog Open A Tastyworks Brokerage Account. About Us Company Info Contact Us Legal Stuff. Helpful Info Help Glossary Cherry Bomb Daily Recaps. Personalities Tom Sosnoff Liz Dierking Tony Battista Jenny Andrews Vonetta Logan Pete Mulmat. Our Apps tastytrade Mobile Bob The Trader Where's Bob?

Personalities Tom Sosnoff Tony Battista Vonetta Logan. Our Sites tastytrade Blog.

More Bob the Trader Get tasty Store. See All Key Concepts. Butterfly Spread Videos watched. Join now Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails.

Join TastyTrade Free Sign up to get our best stuff delivered to you daily and save videos you want to watch later.