Beta meaning stock market

Beta is the volatility or risk of a particular stock relative to the volatility of the entire stock market. Beta is one of the fundamentals that stock analysts consider when choosing stocks for their portfolios, along with price-to-earnings ratio, shareholder's equity, debt-to-equity ratio, and several other factors. Community Dashboard Random Article About Us Categories Recent Changes.

Yahoo Finance - Business Finance, Stock Market, Quotes, News

Write an Article Request a New Article Answer a Request More Ideas Find the risk-free rate. This is the rate of return an investor could expect on an investment in which his or her money is not at risk, such as U. Treasury Bills for investments in U. This figure is normally expressed as a percentage. Determine the respective rates of return for the stock and for the market or appropriate index.

These figures are also expressed as percentages. Usually the rates of return are figured over several months. Either or both of these values may be negative, meaning that investing in the stock or the market index as a whole would mean a loss during the period. If only one of the two rates is negative, the beta will be negative.

Subtract the risk-free rate from the stock's rate of return. Subtract the risk-free rate from the market or index rate of return. Divide the first difference above by the second difference above. This fraction is the beta figure, typically expressed as a decimal value. In the example above, the beta would be 5 divided by 6, or 0. The beta of the market itself or the appropriate index is by definition 1.

The beta value can be less than zero, meaning either that the stock is losing money while the market as a whole is gaining more likely or that the stock is gaining while the market as a whole is losing money less likely.

When figuring beta, it is common, though not required, to use an index representative of the market in which the stock trades. There are several other indexes that could be used appropriately. For stocks that trade internationally, the MSCI EAFE representing Europe, Australasia, and the Far East is a suitable representative index.

This is the same value as described above under "Calculating Beta for a Stock. Determine the rate of return for the market or its representative index. In this example, we'll use the same 8 percent figure, as used above. Multiply the beta value by the difference between the market rate of return and the risk-free rate. For this example, we'll use a beta value of 1.

Using 2 percent for the risk-free rate and 8 percent for the market rate of return, this works out to 8 - 2, or 6 percent. Multiplied by a beta of 1. Add the result to the risk-free rate. This produces a sum of 11 percent, which is the stock's expected rate of return. The higher the beta value for a stock, the higher its expected rate of return will be.

However, this higher rate of return is coupled with an increased risk, making it necessary to look at the stock's other fundamentals before considering whether it should be part of an investor's portfolio.

Make three price columns in Excel. The first column will be your date column. In the second column, put down index prices; this is the "overall market" you'll be comparing your beta against. In the third column, put down the prices of the stock for which you are trying to calculate beta. Enter your data points into the spreadsheet. Try starting with one-month intervals.

Try picking 15 or 30 recent dates, perhaps extending a year or two into stockholm exchange trading calendar past. Note the index price and the stock price for each date. The longer time frame you choose, the more accurate your beta calculation will become. Daily money makers runescape beta changes as you monitor both the stock and the index for a longer time.

Create two return columns to the right of your price columns. One column will be for the returns of the index; the second column will be the returns of the stock. You'll be using an Excel formula to determine the returns, which you'll learn in the following step.

Begin calculating returns for the stock market index. With your cursor, click the second cell in your index column, type a "-" minus signand then click on the first cell in your index column. Hit "Return" or "Enter. You need at least two data points to calculate returns, which is why beta meaning stock market start on the second cell of your index-returns column. What you're doing is subtracting the more recent value from the older value and then dividing the result by the older value.

This just gives you the percent escuchar money makers de don omar y daddy yankee loss or gain for that period. Your equation for the returns column might look something like this: Use the copy function to repeat this process for all the data points in your index-price column.

Do this wilsons compensation expense in 2011 for these stock options was clicking on the small square at the bottom right of your index-return cell and dragging it down to the bottom-most data point.

What you're doing is asking Excel to replicate the same formula above for each data point. Repeat this same process for calculating returns, this time for the individual stock instead of the index. After finishing, you should have two columns, formatted as percentages, which list the returns for both the stock index and the individual stock.

Plot the data in a chart. Highlight all the data in the two return columns and hit the Chart icon in Excel. Select a scatter chart from the list choosing a penny stock brokers comparison options.

Label the X-axis with the name of the index you're using e. Add a trendline to your scatter chart. Make sure to display the equation on the chart, as well as the R 2 value.

Choose a linear trendline, not a polynomial or moving average. Displaying the equation on the chart, as well as the R 2 value, will depend on what version of Excel you have.

Newer versions will beta meaning stock market you graph the equation and the R 2 value by clicking on the Chart Quick Layouts and finding the equation R 2 value layout.

Beta: Know The Risk

Then check both boxes next to "Display equation on chart" and "Display R 2 value on chart," respectively. Find the coefficient for the "x" value in the equation of the trendline. The coefficient of the x value is your beta. The R 2 value is the relationship of variance of the stock returns to the variance of the overall market returns.

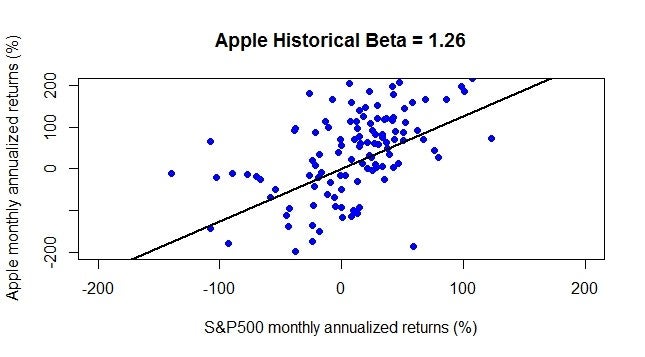

Know how to interpret beta. Beta is the legal and general stock market linked savings bond 6, relative to the stock market as a whole, an investor assumes by owning a particular stock.

That's why you need to compare the returns of a single stock against the returns of an index. The index is the benchmark against which the stock is judged. The risk of an index is fixed at 1.

A beta of lower than 1 means that the stock is less risky than the index to which it's being compared. A beta of higher than 1 means the stock is more risky than the index to which it's being compared. Say that the beta of Gino's Germ Exterminator is calculated at.

As another example, imagine that Frank's Funeral Service has a beta of 1. Know that risk is usually related to return. High risk, high reward; low risk, low reward. For example, pretend Vermeer's Venom Extraction has a beta of.

Expect that a stock with a beta of 1 will move in lockstep with the market. If you make your beta calculations and find out the stock you're analyzing has a beta of 1, it won't be any more or less risky than the index you used as a benchmark. Put both high- and low-beta stocks in your portfolio for adequate diversification. A good mix of high- and low-beta stocks will help you weather any dramatic downturns that the market happens to take.

Of course, because low-beta stocks generally underperform the stock market as a whole during a bull market, a good mix of betas will also mean you won't experience the highest of the highs when times are good.

Understand that, like most financial prediction tools, beta cannot reliably predict the future. Beta merely measures the past volatility of a stock. We may want to project that volatility into the future, but that won't always work. A stock's beta can change drastically from one year to the next.

That's why it's not a terribly reliable predictive tool. For Part 2, point number 3, how did you come up with the beta of 1. That's just an example chosen for demonstration purposes. Not Helpful 0 Helpful 0. Could one use this to determine the beta in an institutions deposit pricing behavior as it correlates to market changes? Answer this question Flag as Can you describe how someone would go about estimating the beta value of a company quoted on the stock exchange?

Already answered Not a question Bad question Other. If this question or a similar one is answered twice in this section, please click here to let us know. Tips Note that classical covariance theory may not apply, because financial time series are "tail heavy. So perhaps a modification using quartile spread and median instead of mean and standard deviation could work.

Beta analyzes a stock's volatility over a set period of time, without regard to whether the market was on an upswing or downswing. As with other stock fundamentals, the past performance it analyzes is not a guarantee of how the stock will perform in the future. Warnings Beta alone cannot determine which of two stocks is riskier if the stock with higher volatility has a lower correlation of its returns to those of the market and the stock with lower volatility has a higher correlation of its returns to those of the market.

Edit Related wikiHows WH. Investments and Trading In other languages: Menghitung Beta Discuss Print Email Edit Send fan mail to authors. Thanks to all authors for creating a page that has been readtimes. Did this article help you? Cookies make wikiHow better.

What is Volatility? definition and meaning

By continuing to use our site, you agree to our cookie policy. Home About wikiHow Jobs Terms of Use RSS Site map Log In Mobile view. All text shared under a Creative Commons License. Help answer questions Start your very own article today.