How are stock options taxed in india

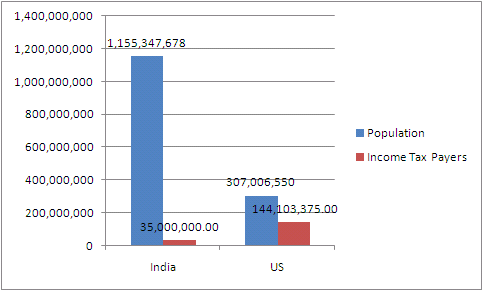

We're proud to announce that RKSV has taken a giant leap forward and is now Upstox. Most of the Indian Taxpayers irrespective of their earnings through business, jobs, services, indulge in Share trading because it is the quickest way of earning handsome money.

It is therefore, necessary to know the taxation on the earning from share trading. But, before going into the taxation part, first it is important to understand what type of share trading activity you are indulging in, whether it is Taxable as Business Income or not. Till assessment year , the Income Tax Act, did not have any special provisions dealing with taxation of derivatives transactions in general, and dealing with futures and options in particular, though derivatives contracts have been traded on Indian stock exchanges since The Finance Act has amended the provision to section 43 5 , with effect from Assessment Year , to provide that derivatives trading transactions would not be regarded as speculative transactions, subject to the fulfilment of certain conditions.

The most common issue that arises in taxation of derivatives transactions is that of whether derivatives transactions are always to be regarded as business transactions.

It is true that in most cases, derivatives transactions would be regarded as business transactions on account of the following factors:. However, the issue of whether an activity amounts to a business or not depends upon various factors, and is not decided just because of the existence or absence of any one circumstance. There can be situations where derivatives transactions may not amount to a business. For instance, derivatives transactions may be carried on by an investor to hedge his investment portfolio.

In such a case, the mere fact that the investor had to square up his derivatives position every 3 months and take up a fresh position, or pay mark-to-market on a daily basis, would not detract from the fact that the prime purpose of such transactions was to preserve the value of the investment portfolio.

Another common practice in the stock markets is arbitrage between the cash market and the futures market. It is a well known fact that the difference in prices between the futures market and the cash market is primarily dictated by the short-term interest rates, and such difference is normally equivalent to the interest that one would earn on short term lending. Therefore, a person having surplus funds may buy shares in the cash market, while simultaneously selling an equal amount of futures of the same share in the futures market.

He would take delivery of the shares bought in the cash market. On maturity of the futures, the shares bought in the cash market would be sold in the cash market. Since the futures would be squared off at the cash market price, the profit on the transaction would normally consist mainly of the difference between the initial purchase price in the cash market and the initial sale price in the futures market, with small adjustments for expenses such as brokerage, securities transaction tax, service tax and the market spread between the buying and selling quotes in the cash market.

Are such arbitrage transactions business transactions, or are they really in the nature of interest seeking transactions? If one looks at the substance of these transactions, they are not motivated by a desire to earn profits, but just to avail of the benefit of the short term interest rates.

There just two legs of the transaction — the purchase and futures sale, and the expiry of futures and cash sale.

The income element in the transactions is determined right at the outset, and does not fluctuate to any material extent, even if there is substantial volatility in the market.

It may be however noted that other factors, such as frequency of transactions, nature of other business carried on, etc. The question arises that in a situation where derivatives transactions are not business transactions, under which head of income should such transactions be considered?

The answer to this question would partly depend upon the substance of the transactions. If the transactions are in the nature of interest-seeking transactions, then going by the substance of the transactions, the income from such transactions may be considered as interest. But if the transactions are in the nature of hedging of investments, how would they be taxed? A derivative, being a security and a right under a contract, is certainly a valuable right, which is capable of being assigned.

The right under the derivatives contract can therefore certainly be regarded as property, and therefore as a capital asset. The issue which arises is — is there a transfer of the capital asset? When the transaction is squared up by an opposite corresponding transaction, there is certainly a transfer. But in cases where the squaring up is on expiry of the contract, can a transfer be said to have taken place?

As held by the Supreme Court in the case of CIT vs. A view is therefore possible that on expiry of the derivatives, there is a transfer of the capital asset.

If derivatives transactions are business transactions, the question then arises as to what constitutes the turnover in derivatives transactions for the purposes of section 44AB or for other purposes? In the case of futures, the purchases of futures are not recorded as a purchase in the books of account, nor are the sale of futures recognized as a sale.

The margin paid is certainly not the turnover, and neither can the futures sale be regarded as a sale in the light of such accounting treatment. At best, only the difference profit or loss on the futures transaction can be regarded as turnover.

The question then is — should one net off the profits and losses and is only the net profit or loss to be regarded as the turnover? This does not appear to be proper, as the net profit or loss would not reflect a measure of the actual volume of transactions. It should be the gross differences which would constitute turnover, and not the net differences. The scrip wise gross differences for each maturity should be determined, the negative signs of the losses within scrip of each maturity ignored and such losses grossed up with the gains to compute the turnover.

In the case of options, only the premium and margins paid is reflected in the books of account at the inception of and during the currency of the option. The strike prices of the margins do not get reflected in the books of account, except for the limited purpose of identifying different sets of options. If a long straddle option is kept for the entire month till expiry, how will this be treated in taxation?

If trading is done in Straddle option or any derivative, as per the Income Tax Act, the income from this would be considered under the head Profit and Gains from Business or Profession i.

Dear sir, if i keep a nifty position for two days and then closing what will be the turn over,and which section of incometax act this comes under. A carried out electronically on screen-based systems through a stock broker or sub-broker or such other intermediary registered under section 12 of the Securities and Exchange Board of India Act, 15 of in accordance with the provisions of the Securities Contracts Regulation Act, 42 of or the Securities and Exchange Board of India Act, 15 of or the Depositories Act, 22 of and the rules, regulations or bye-laws made or directions issued under those Acts or by banks or mutual funds on a recognised stock exchange; and.

B which is supported by a time stamped contract note issued by such stock broker or sub-broker or such other intermediary to every client indicating in the contract note the unique client identity number allotted under any Act referred to in sub-clause A and permanent account number allotted under this Act;.

Turnover must be firstly calculated, in the manner explained below:. The total of positive and negative or favorable and unfavorable differences shall be taken as turnover. Premium received on sale of options is to be included in turnover. In respect of any reverse trades entered, the difference thereon shall also form part of the turnover.

Here, it makes no difference, whether the difference is positive or negative. All the differences, whether positive or negative are aggregated and the turnover is calculated.

It has two sides: If FnO Income is treated as business income — STT and all the other expenses are deductible. If FnO Income is treated as capital gain — all the expenses related to purchase and sale of such transactions are deductible other than STT. I am working in a PSU and is currently trading in Options. Now I have the following questions: Will it be a short term gain for me or business income? Deductions applicable on the taxes, brokerage etc.

How to calculate the turnover and does it requires any audit? Any other rules of IT Act applicable on me being a PSU employee. Tax will be charged on such income at the normal rates applicable to an individual treating it as normal business income.

Any expense incurred for carrying on the business can be claimed as business expense including brokerage, Stamp Duty, Security Transaction Tax.

Shares under employee stock ownership plan are taxed at the time of allotment and sale - Livemint

Suppose loss from transaction one is Rs. If turnover exceeds 1 core, tax audit is applicable. Now in , I have made profit of 2. Section 1 defines the time within which the return should be filed depending upon the assessee. The time period for filing the return for AY in your case will be 31st July If you have not claimed the loss while filing the return than this loss cannot be carried forward and will be deemed as dead loss. For , the income of 2. The said amount will be added to your salary income and tax would be applicable as per the relevant slabs.

Futures and Option trading basically being non delivery based trading is taxable as business income. Sir the current situation is interpreted by different people differently. As per above discussion, you told that the sum of profit and loss of each transaction will be considered as turnover.

Here you cleared what is turnover,, now in such case, what will be purchased? In case the loss under this category is to be carried forward, the return for the Financial Year should have been filed by 31st July considering you are not liable for tax audit.

You can file the return upto 31st March , after this date the return would become time barred. Since you have loss in your return, therefore no interest is payable. Yes all the expenses can be claimed, if they are incurred for the business. In respect of payment for laptop or desktop, depreciation will be claimed on these. Dear Sir, I regularly deal in shares in 4 categories: Specualtion gain during the year: Short term loss on shares: Notional gain on shares: Whether tax audit is applicable in my case?

Also whether the loss in one head cna be set off profit under another head? The turnover has been discussed earlier in the comments. Turnover must be firstly calculated, in the manner explained below: In regards to tax computation and audit requirement, kindly consult your tax advisor. My understanding based on the above content is that the Future Transactions NSE based will be accounted under Business Income and not as Speculative Transactions.

Hence, it will be taxed as per taxation laws for income and not as Capital gains. You have mentioned the calculation for Turnover for Future transaction in multiple comments above — and I get it. I ask this question because my C. Hence, if you can please point me in the right direction, I will be able to pick this up with my C.

In one simple question. If i have earned say 50 Lkh in Only Option Trading in whole year. How to calculate turnover in options trading?

I had purchased option for 10 lacs in nifty and stock as i was bullish but made loss and no stt was paid as i had only purchased option and they expired can i adjust this loss against business income. Still if you get profit on monthly basis, whether short term capital gains tax should be paid?

The income will be shown as a business income, taxable under the head Profit Gains from Business and Profession. A profit and loss account of your trading, to ascertain the gross income and the expenses so incurred on it, is required. You can deduct the expenses directly incurred on earning this income.

Other than this, the normal documents i.

PAN, bank details, etc are required. She borrowed 5 lakhs from me and she made a profit of 2 lakhs till now. In Derivative transaction turnover is very important , whether the differences in transaction i. Tax would be calculate as per the income slab she falls in. It will be done as per the income slab.

Yes, she can claim the benefit of 80C investment to reduce her tax liability. How to find turnover of Option Trading , According to ICAI Guideline: So the difference of Option Trading is loss or profit but what is this premium received on sale of option is also be included in turnover means what suppose option buy Rs. Or turnover is Rs. I invest in market rs. My total turnover is 1crore in and I am private tuition teacher my income is rs per month so not file itr for and and I hope you are calculating the turnover correctly.

Since your turnover is above the minimum limit for tax audit purpose, you were required to file your return during the time limit set under it. The returns for all the financial years are time barred now and cannot be filed. However, once the turnover is proven, the AO has the authority to issue penalty on you equivalent to 0. I do on and off trades in futures buying stock and sells them when they are in profit or sometimes loss and or carry forwarding them also and simultaneously in same account I keep the delivery of equity of stock for months ….

Should Gains of stock future fall in general tax slab? And gains from equity stock which I keep for months fall in short term capital gain slab? Sir, the gain from derivatives will always be considered as your business income and taxed as per your slab. For equity, you need to check, whether these trades were done for the purpose of investment or for the purpose of profit, and secondly the frequency of transactions done. It is the discretion of the AO to check this.

However, in your case the frequency of transactions are not lot and therefore the gains from the same should be taxed under head capital gain only. Turn over here is 40? Turn over is ? I would like to know how much tax liability will occur if these income and loss setup each other. Could you please provide answer to following question: Request you revert at earliest. Sir, I hope you are calculating the turnover correctly. I had suffered a loss of Rs.

I had declared this as other business income Gross Receipts as 0, Expenses as I received a Notice that without the Gross Receipts how can you have expenses and loss. What would be my Gross Receipts. Since I have a loss to be carried forward, will this have penalty under section 44AB for not having the Tax Audit. Tax audit is subjective to the turnover that is done. For AY , the limit was Rs. If your turnover was above the limit than you had to get audit done from a CA and file your return accordingly.

I trade age 30 in commodity derivatives both MCX and NCDEX.

Employee Stock Option Plan(ESOP) Taxation In India - With Benefits &Tips

I have not filed IT Returns. Please clarify the following:. Whether this is true that Tax Payer can have choice like adopting any of the above methods or any guidelines are there for this?

If I file Returns calculating as above, will there be any chances that IT Department questening me in future?

Please inform me which of the following methods I should adopt to pay Income Tax ie,. Proper financials will also go with your return, i. It is advisable to show actual profit and deduct the expenses from it. For further queries please consult a CA. I have made a profit of Rs. I would appreciate an early response, as this is really worrying me.

I want to know that whether my carried forward loss thru mcx derivative trading of previous two years can be set off against business income in this current year. Lost 2 L Rs in Equity trading between Lost 2L Rs in Margin plus trading between Earned around 6L Rs in Nifty Options from Mar.

So I want to know how much tax I need to pay total and can I offset my 4L losses from earlier years against this profit. Considering this as loss under capital gain.

This can be carried forward for 8 assessment year. Loss for assessment year i. This is business profit. The loss of 2L of margin plus trading can be set off against it.

You will have to pay tax as per your slab rate on the remaining amount i. So, the loss of Capital Gain head cannot be set off against Business profit. The same loss of Rs. The method for calculation of turnover has been clarified by a Guidance Note issued by ICAI. I trade in futures from home. Also can i show commission expense as an individual? Adding full home rent and telephone bill may not be correct.

You need to proportionate the expense in terms of how much it may be used for personal and official purpose. Yes, you can show commission expenses as an individual. As told earlier, it is a matter of ambiguity. You need to see the frequency of the transaction, volume and other factors. You also need to see how you are showing this kind of income in the past years.

As per the current situation, it seems you have done good amount of trading, so considering it as business income should be fine. However, please contact your CA for final say on this. The turnover is mentioned in ITR-4 for 44AD purposes. HI Elvis, Nice info.. Do i need to get my books audit in this case? Turnover is more than 1 crore — tax audit is required 2. My turnover as per the daily mark to market differences is not more than 8 lacs.

First of all I am not able to get these statements of daily mark to market differences from my broker which was ICICI Web Trade Limited. I made a loss of Rs. I stopped trading after 4 months of this loss making experience. This is not my regular profession. Am I liable to tax audit? Can I carry forward my loss over the next financial years without tax audit?

Under what head should I show this loss? When is my last date of tax filing to carry forward this loss? You can carry forward the loss only after getting the audit done.

The other option you have is to maintain proper books of accounts and not go under presumptive taxation method. In this case you can show the actual profit or loss without getting the audit done. If you are subject to tax audit then the last date was 30th November for financial year income. For non tax audit return, due date was 31st July.

The return needs to be filed before the due date if you want to carry forward the loss. I just need one clarification in your reply: I have accounts statement from my broker for every transaction made and I was maintaining an Excel sheet of all details. Just maintaining on excel is not sufficient. So why would one need to prepare a balance sheet? In my company they have deducted TAX on my salary. So please adivise can get my deducted TAX back by showing 8 lakhs loss during ITR filing.

Now my questions is if i shown my turnover amount Rs. The turnover is not shown on the credit side. As FnO transactions constitute a business, you will have to maintain proper books of accounts to show the loss of Rs 7,92, You can claim all the business related expenses against this FnO transactions. All the expenses are shown on the debit side. This is a really helpful blog that you have put up. I am actually facing a problem with my Tax filing.

I had done some. Future transactions in the FY Total value of these transactions crossed 1 crore by total value I mean — sum of. My CA says that is how we should be calculating the Turnover.

But based on what you have detailed here in this blog, I understand that it is the absolute sum of the profits and losses that. I make on the Future transactions that would account for my turnover. And going by this calculation, the amount is only close. Which is mostly loss only. Can you please confirm that. Yes, the turnover should be calculated in the absolute sum, which is mentioned in the blog.

And making loss of Rs. Approx Now i would like to know how to fill return for this year. I have to show all the transaction i made or only turn over difference i have to show. I am regular trader And my income is less than taxable income than It is compulsory for me to fill return. Sir, Pls help me, i have the following doubts for calculating turnover 1. Where the transaction for the purchase or sale of any commodity including stocks and shares is delivery based whether intended or by default, the total value of the sales is to be considered as turnover.

Should I need to get audit by a CA firm being Loss. Also pls suggest in which column of ITR IV to show credit of Rs.

The profit and loss should be maintained by showing your gross profit or gross loss and then setting off the expenses against it.

You can also claim and any other business expense incurred to earn this FnO income which is considered as business income. The loss of FnO can be set off against income from other sources and the rest can be carried forward. However, please note that the loss of FnO cannot be set off against salary income. Any transaction done under FnO is to be treated as business income and is taxed under the head Profits and Gains from Business Profession.

Therefore, no short term capital gains would be calculated. Proper books of accounts need to be maintained.

Please give an example. Income tax philosophy is to give to government part of some thing which you earn or gain or profit or end up with more than what you started with. Does it needs to be included only when the option is not squared off? Thanks for the informative post. It was really helpful.

Suppose I carry a futures position from one financial year to the next, do I pay tax on the daily mark-to-market settlement upto March 31st of the year in which the transaction was initiated or is it counted only when I settle the position? I buy one lot of SBIN futures on March 26, and my mark-to-market profit from the daily futures settlements is upto March 31, However, I close my position only on April 1, for a total profit of In this case, does the Rs. The taxation of such income depends upon the accounting method followed by you.

If in the earlier years you have booked income on accrual basic i. However, you need to be consistent in following the accounting method and not change it year on year basis depending upon the income or loss. Yes, you can account for the same once they are closed. Do take care to follow the same method in the future years. If your gross total income before claiming deduction under Chapter VI-A is above Rs. Income under FnO is a business income and ITR4 needs to be filed for the same.

Elvis Your post were proved useful to me. However I have some doubts. My question is favourable and unfavourable differences are available with the assessee i.

The intention to legislate section 44AD is to help small time traders who find it difficult to maintain proper books of accounts and accordingly to ascertain the amount of profit earned.

In case, profit can be ascertained with reasonable efforts section 44AD shall not apply. In those cases, tax needs to be paid on the actual amount of profit earned based on the available information. You shall also fall in the same category and accordingly you need to pay tax on the actual profit. Can the expenses incurred like Internet Charges, Rent, Electricity and Fuel Petrol be deducted from the Profits.

Also the assets used like Computers, House, Furniture and car be depreciated if yes at what rate. The income from FnO is treated as business income. Yes, you can show the expenses and depreciation which are related to earning such income. I did option trading through online trading in US stock market and incurred a loss of about rupees one lakh. I have other source of income like professional income ,interest income and short term capital gains from Indian Stocks.

Please advice me how to treat my loss from option trading in US market in my ITR. Sorry for delay in replying. Could you please clarify on the accounting treatment for the following futures transactions put together for the FY Sell Qty Nil as the positions were taken on 27th March and the settlement will be done only on following thrusday i.

To Rent 60, By Profit for Scrip 2 2,33, Thanks for this write up. What about the taxability of unexpired contracts at year end. I entered into April futures for a scrip. And as on 31st March the stock prices soared. So as on 31st March my MTM inflates.

Tax implication of employee benefits: Things to remember - EY - India

But until 30th April, this MTM is subject to market volatility. The contract is active and not squared off. Do I pay tax on this unexpired contract as on 31st March? As told earlier, choosing whether to show expired profit depends on the accounting practice so followed.

The accounting practice should not change from year to year. I have a SIP in 4 equity mutual fund schemes with dividend payout option. I almost never sell equity mutual funds. Zero SELL transactions in the year. I fully sold my other investments to re-align the portfolio into the equity funds as said in point a above. This has resulted in some LTCG and some STCG. I have parked my cash in 5 liquid funds.

I sell some of these every 3 months for my living. About 4 to 8 SELL transactions in the year. I hedge my equity mutual fund holdings with equal NIFTY PUT options. I renew the PUT options every two months. Depending on how the market goes, I incur profit or loss in PUT options.

I understand this goes under business income. About 6 to 16 SELL transactions in the year. Is it correct to show the gains and losses under appropriate heads as described above or everything should be under business income? Transaction volume altogether is about 25 SELL transactions in the year.

For equity mutual funds, you need to see the following things, whether these trades were done for the purpose of investment or for the purpose of profit and secondly the amount of transactions done. It is the discretion of the Assessing Officer to check this. However, in your case the amount of transactions are not lot and therefore the gains from the same should be taxed under head capital gain only.

Regarding, the transactions in derivatives, that will always be seen as business income.

Dear Elvis, I got INR as business commission in my personal enterprise bank account from GOA. Now my question is this commission is taxable or not. The commission income will be taxable at the normal slab rate. You can however, claim expenses done to achieve this income. Dear Elvis, Please clarify the following points. From the earlier postings I was able to understand ,any points.

In my case the turnover in FO segment for FY is Rs8 Lacs approximately. I incirred a loss of Rs 5 Lacs. I also have portfolio of shares where I take delivery of Shares and pay STT. Here I have made a profit of about Rs 5lacs. I consider this as STGG. This year while filing the return ITR4, I want to set off the FO loss against the STCG. I do not want to carry forward small loss in FO segment after set off against STCG, My question is should I have a Tax Audit conducted to declare a loss in FO segment as business loss?

What is the correct position. My CA in Chennai says as my TO is less than 1 crore and I can declare the loss without tax audit being conducted. Can you suggest any CA in chennai for this? You can send a PM to subra51 yahoo. Now lets go step by step. The loss of Rs 5 lakhs under FNO is a business loss. The transactions in shares is shown under the head Capital Gain. Since transactions in equity trading is short term, business loss of FNO can be set off against it.

Now in your case, if you maintain proper books of accounts, i. Yes your CA is correct, since your turnover is less than 1 crore, you can declare the loss without getting the tax audit done, however for that you need to maintain proper books of accounts.

From your above response i deduce that since turnover is less than 1 crore, we can declare the loss without getting the tax audit done, however for that we need to maintain proper books of accounts in case of individual. And what if i have Pension income of 5. Can i still Carry forward loss without getting Audit done? Can i set of FD interest income against FNO loss of 9 lakhs.

If yes then where to show FD interest in ITR4 form. Also if answer to question 2 is Yes then can i set off remaining FNO loss with next year FD interest income? Is audit required in my case? Is it necessary to file losses? What ITR should be used in my case? I asked a CA for computation and he clubbed all losses under STCL which is making me consult another one. What are your thoughts on the same? Yes disclosing the loss is necessary. It is a legal requirement to do the same.

Losses will be disclosed as following:. Dear Elvis Thanks for your valuable suggestions. If I sum up the credit transactions then it constitutes a very large amount in crores and i have suffered a loss of about Rs. Yes you can but ensure to file the return on time. FD interest is shown under other income. While making the final computation, loss of FnO business i. The net loss will be carried forward, if any. The business loss i. FnO loss can be set off against business income only in the next year.

You will not be able to set off the unabsorbed business loss with FD income in next year. I have one more case 1. WHat if i have ONLY FNO loss of 3. Do i need to get Audit done to carry forward this loss or just maintaining my Book of Accounts is enough? Can i set off this Carry forwarded loss against LTCG from selling a residential plot next year? Maintaining of books of accounts is enough. No this loss cannot be set off with LTCG.

Sometimes intraday and sometime BTST. Will it be considered as speculative income? How can i calculate the turnover from my transactions? When auditing is required? Transactions in derivatives are not considered as speculative transaction, as per Section 43 of Income Tax IT Act, Therefore, in such transactions, the aggregate of the difference amount, i. An audit is required if you have a business income and if your business turnover is more than Rs.

Audit is also required as per section 44AD in cases where turnover is less than Rs. Thanks for your quick response Elvis. Let me clarify my understanding with an example. Is the difference of favorable and unfavorable trades in FNO to be calculated lot wise as in first in first out or contact wise? May I opt to file my ITR in ITR-4S for FY on presumptive taxation basis under sec 44AD for my income from trading in futures and options if my turnover is not more than 2 crores?

If the above conditions are satisfied then you can file your return under section 44AD i. For advance tax, from the AY , as assessee is required to pay advance tax related to such business. However, advance tax can be paid during the financial year on or before 15th March no need to pay advance tax related to such business on or before 15th September or 15th December So, in this case what is Turnover amount.

How can I carry forward this loss? What need to do for this in , as I have done nothing for 2 years. The loss in your case cannot be carried forward, as for FY , the return should have been filed by 31st July other than tax audit assessee. Hi , sir my question is in regard of future transaction on NSE , if one has entered in one transaction of future for month of may on 21 march what will be the gain and loss to be show for the trasaction if it is not squre-up as on 31 march and what amount to be added in the turnover in that case?

What to mention in nature of business in the ITR4 Form? I did intraday trading in year , and incurred loss of And also did delivery based trading and incurred a loss of So do I have to undergo a tax audit? And also do I have to maintain books of accounts?

Or I can avail option of Section 44AA, as it was my first year of speculative business? Dear Elvis, i am planning for algo trading in future.

As per my calculation the turover in nifty may be more than 40cr. I have closed the demat account so cant take benefit of loss to be settled of so why i have to pay even i have incurred the losses.

I think this has the most sane description of what is turnover for futures and options options in particular while brokerage firms like zerodha show extremely high turnovers for options trading…it should be the same treatment as futures…. IN-DP-NSDL RKSV Commodities MCX Member Code: RKSV, New Delhi House, New Delhi Sunshine Tower, 30th Floor, Senapati Bapat Marg, Dadar W , Mumbai - For any complaints email at complaints rksv. Please click here if you are not redirected within a few seconds.

ESOPs in India - Benefits, Tips, Taxation & Calculator

You are using an outdated browser. Please upgrade your browser to improve your experience. Whether Always Taxable as Business Income The most common issue that arises in taxation of derivatives transactions is that of whether derivatives transactions are always to be regarded as business transactions. It is true that in most cases, derivatives transactions would be regarded as business transactions on account of the following factors: The purpose behind entering into most derivatives transactions is to profit from short-term fluctuations in market prices.

The period of any derivatives transaction cannot exceed 3 months, and such transactions are invariably short-term transactions. Often, the sheer volume of trades in derivatives transactions entered into by a person on an ongoing basis indicates that it amounts to a business. Many people who trade in derivatives may be associated with the stock market in some way or the other — they may be stock brokers or their employees, or regular day traders. For such people, derivatives trading are an extension of their normal business activities.

If not Business Income, under which Head Taxable The question arises that in a situation where derivatives transactions are not business transactions, under which head of income should such transactions be considered? Hi, If a long straddle option is kept for the entire month till expiry, how will this be treated in taxation? Section 43 5 provides that FnO transactions will not be treated as speculative if,: Hi, I am working in a PSU and is currently trading in Options.

Please find below point wise reply: I AM TRADING IN OPTION TRADE.. HOW WILL BE ITS TAX TREATMENT? Dear Sir, The turnover has been discussed earlier in the comments. Hi Elvis, Thanks for explaining the Derivative Taxation Topic in such detail. This was really helpful. But I still have some questions, for which I seek your help — 1.

Thanks for all your help. Kunal, Please find my comments below: Yes this is correct. It is taxable as business income.

It is included under section 44AB. Hi, I do options trading only. Same if I sell it in premium 50, then what would be the turnover? Anish, as told earlier: Vijay, Please find below reply to each point: My query is 1 How much percentage she should pay towards tax? Sai, Please find below reply to each point: All of the above will be considered, if the said amount is shown as a loan. Sachin, The turnover in this case will be the net profit i.

Hi, I have query on turn over calculation. Dear Sir, Please find the reply to each point: Sir, the total turnover is You need to consider the absolute values. Sir, Yes it is the same way. I have some loss and profit for FY — Dear Sir, you need to consult your Tax Advisor or CA for this.

Dear Sir, Tax audit is subjective to the turnover that is done. Sir, I trade age 30 in commodity derivatives both MCX and NCDEX. Please clarify the following: Dear Sir, I have question on the taxation I need to pay… 1. Earned around 6L Rs in Nifty Options from Mar So I want to know how much tax I need to pay total and can I offset my 4L losses from earlier years against this profit. Vijay, Please find the answer to each points mentioned below: This is a loss under the head PGBP. This can be carried forward to financial year Hi Nem Singh, The method for calculation of turnover has been clarified by a Guidance Note issued by ICAI.

Dear friend thanks for your valued information! I am also well aware about it. Lakshay, Adding full home rent and telephone bill may not be correct. Jagan, As told earlier, it is a matter of ambiguity. Anirban Roy, Please find the reply below each question: In the current case audit is not required as no condition is satisfied.

Hi Kuldeep, We need to see the applicability of audit from two point of view. The return will be filed as ITR You will show this loss under PGBP i. Thanks a Lot Elvis. Your explanation was very detailed. Dear Satish, The turnover is not shown on the credit side. Hi Elvis, This is a really helpful blog that you have put up. I had done some Future transactions in the FY My CA says that is how we should be calculating the Turnover — and by his calculation the turnover crosses 1 crore mark and hence a tax audit is necessary.

But based on what you have detailed here in this blog, I understand that it is the absolute sum of the profits and losses that I make on the Future transactions that would account for my turnover. And going by this calculation, the amount is only close to 10 lakhs. Also, can you please point me to the specific article in the IT law that states this — so that I can take it up with my CA as well.

Please reply back to this post. Hoping to hear back soon from you regarding this. Dear Kunal, Yes, the turnover should be calculated in the absolute sum, which is mentioned in the blog.

Below is the PDF link: Dear Sir, Please find the answers as follows: I think you are not calculating the turnover the correct way. Kindly recalculate your turnover. Dear Praji, Please find below the reply: The turnover in such types of transactions is to be determined as follows: Vijay, Please find the answers as below: Yes the profit and loss are considered as business income.

What do you say? Hi Elvis, Please clarify below point specific to calculation of option trading turnover. In case you have a different opinion , please share your thoughts on it. Hi Elvis, Thanks for the informative post. Hi, The taxation of such income depends upon the accounting method followed by you.

Option Trading for Beginners IndiaHi, Yes, you can account for the same once they are closed. Dear Mohit, The intention to legislate section 44AD is to help small time traders who find it difficult to maintain proper books of accounts and accordingly to ascertain the amount of profit earned.

Dear Kakarla, The income from FnO is treated as business income. Dear Surinder, Sorry for delay in replying. Dear Mr Elvis, Could you please clarify on the accounting treatment for the following futures transactions put together for the FY For Scrip 1: Buy Qty 2,52, Shares Buy Amount 13,00,86, Buy Qty 3, Shares Buy Amount 3,84,02, Buy Qty 2, Shares Buy Amount 15, Sell Qty Nil as the positions were taken on 27th March and the settlement will be done only on following thrusday i.

Hi lokesh i have same query can u share ur mobile no or call me at Dear Lokesh, Sorry for delay in replying. Hi Nevill, As told earlier, choosing whether to show expired profit depends on the accounting practice so followed.

Dear Elvis, You are running a great thread, thank you very much!!! I do following trades over the year: Dear Muthusamy, For equity mutual funds, you need to see the following things, whether these trades were done for the purpose of investment or for the purpose of profit and secondly the amount of transactions done.

Dear Didar, The commission income will be taxable at the normal slab rate. Hi Elvis I am a trader at RKSV From your above response i deduce that since turnover is less than 1 crore, we can declare the loss without getting the tax audit done, however for that we need to maintain proper books of accounts in case of individual.

Hi Elvis I have one more case 1. Dear Elvis, I would be glad if you could shed some light on my questions. Dear Manish, Please find the answers below: Audit is not required. You will be required to file ITR 4. Losses will be disclosed as following: Dear Nishant, The turnover in such types of transactions is to be determined as follows: Dear Vijay, Please find the below reply to each point: Dear Vijay, Please find the below reply: Thanx Elvis for clearing my doubts.

Dear Anbu Victor, Transactions in derivatives are not considered as speculative transaction, as per Section 43 of Income Tax IT Act, Hi, It should be calculated lot wise — FIFO basis.

Hello, May I opt to file my ITR in ITR-4S for FY on presumptive taxation basis under sec 44AD for my income from trading in futures and options if my turnover is not more than 2 crores? Hi, The following conditions need to be satisfied: Elvis Sir, Many thanks! Hello Elvis I did intraday trading in year , and incurred loss of This was my first year of transaction. Hi Elvis, Pls answer me ……. For inquiries mail support upstox. Pricing Demat Account NRI Refer and Earn. Upstox Pro Web Upstox Pro Mobile NEST Desktop.

Get the upstox app. Sitemap Privacy Policy Glossary.