Black scholes option pricing volatility

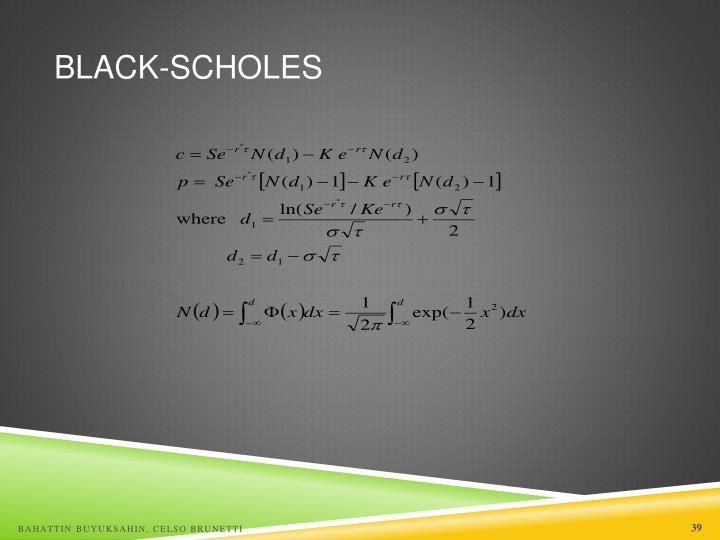

Volatility and Black-Scholes motivated by a discussion on the Wealthy Boomer Okay, so we need to determine some Volatility value so we can stick into the Black-Scholes formula.

In Excel, that'd be: The way to calculate Standard Deviation or Volatility varies from one guru to another.

To determine a stock's historical volatility, calculate the equilibrium level midpoint of a stock's price range. Then simply divide the difference between the high point and the equilibrium level by the equilibrium level to get the volatility percentage. Volatility is found by calculating the annualized standard deviation SD of daily change in price where???

Presumably, for Black-Scholes , one wants a Volatility number which gives a good estimate of the actual value at which the option is currently trading.

Or one can ignore the definitions and just fiddle with the Volatility number until you get a good Black-Scholes value.

ESOs: Using the Black-Scholes Model

I'm not interested in options. I'm interested in what Volatility value will give a Black-Scholes value which agrees with the current option premium. For example, I look at GE call options and the current GE stock price and I fiddle with the Risk-free rate and Volatility value and get the charts here First I notice that changing Rf, the Risk-free Rate, isn't as important as picking a good V.. Yes, and the Volatility can vary quite a bit: