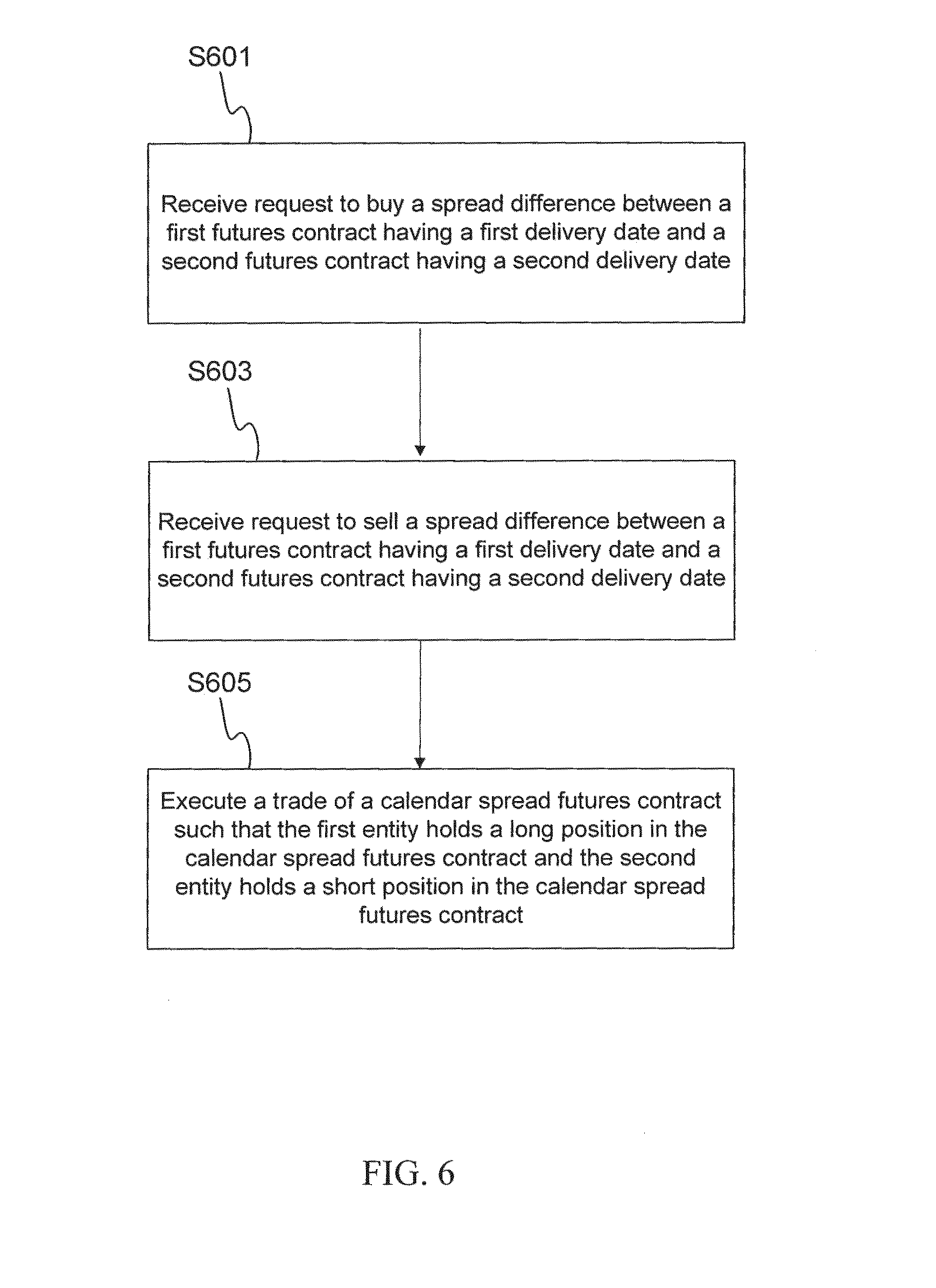

Calendar spread contract

The VIX Index is calculated using SPX quotes generated during regular trading hours for SPX options. Embedded numbers denote the specific week of a calendar year during which a contract is settled.

For symbology purposes, the first week of a calendar year is the first week of that year with a Wednesday on which a weekly VX futures contract could expire. The Exchange may list for trading up to six near-term expiration weeks, nine near-term serial months and five months on the February quarterly cycle for the VX futures contract.

VX futures that have a "VX" ticker are not counted as part of the six near-term expiration weeks. For example, if 4 near-term VX expiration weeks, 3 near-term serial VX months and 1 VX month on the February quarterly cycle were listed as of April 7,these expirations would have the following ticker symbols: VX15 expiring Wednesday, April 13, VX expiring Wednesday, April 20, VX17 expiring Wednesday, April 27, VX18 expiring Wednesday May 4, VX19 expiring Wednesday, May 11, VX expiring Wednesday, May 18, VX expiring Wednesday, June 15, VX expiring Wednesday, July 20, The end of day submission cut-off time for all Orders, quotes, cancellations and Order modifications for VX futures other than for the expiring VX future on its Final Settlement Date is 3: Any Orders, quotes, cancellations or Order modifications submitted after the end of day submission cut-off time will be automatically rejected by the Exchange.

Market Orders for VX futures contracts will not be accepted by the Exchange during extended trading hours for the VX futures contract or during any other time period outside of regular trading hours for the VX futures contract. Any Market Orders for VX futures contracts received by the Exchange outside of regular trading hours for the VX futures contract will be automatically rejected. Stop Limit Orders are permitted during regular and extended trading hours for the VX futures contract.

Click here for domestic and international holiday session trading hours. Trade At Settlement Transactions: Trade at Settlement "TAS" transactions are permitted in VX futures and may be transacted on the CBOE System, as spread transactions, as Block Trades including as spread transactions and as Exchange of Contract for Related Position transactions. The trading hours for all types of TAS transactions in VX futures are during extended trading hours and during regular trading hours until two minutes prior to the close of regular trading hours at the end of a Business Day.

TAS transactions in an expiring VX futures contract are not permitted during the Business Day of its Final Settlement Date. All Orders, quotes, cancellations and Order modifications for TAS transactions during trading hours must be received by the Exchange by no later than two minutes and one second prior to the close of trading hours at the end of a Business Day and will be automatically rejected if received by the Exchange during trading hours after this cutoff time. Any TAS Block Trade or TAS Exchange of Contract for Related Position transaction reported to the Exchange later than two minutes prior to the close of regular trading hours at the end of a Business Day may only be for the next Business Day.

The permissible minimum increment for TAS non-spread transactions in VX futures that are transacted on the CBOE System is 0. The permissible minimum increment for TAS Block Trades including as spread transactions but not as a strip and TAS Exchange of Contract for Related Position transactions in VX futures is 0.

Any TAS transaction must satisfy the requirements of CFE Rule A. All TAS orders are required to be Day Orders. TAS Market Orders and TAS contingency orders are not permitted. VXT is the ticker symbol for VX TAS transactions. The VX TAS ticker symbol will map to the VX futures symbol for that expiration week. For example, if 4 near-term VX expiration weeks, 3 near-term serial VX months and 1 VX month on the February quarterly cycle were listed as of April 7,the TAS symbols would be the following: VX Futures Symbol VX TAS Symbol Final Settlement Date VX15 VXT15 April 13, VX VXT April 20, VX17 VXT17 April 27, VX18 VXT18 May 4, VX19 VXT19 May 11, VX VXT May 18, VX VXT June 15, VX VXT July 20, CFE Rule h - Crossing Two or More Original Orders.

The eligible size for an original Order that may be entered for a cross trade with one or more other original Orders pursuant to Rule is one Contract. The Trading Privilege Holder or Authorized Trader, as applicable, must expose to the market for at least five seconds under Calendar spread contract a at least one of the original Orders that it intends to cross. CFE Rule m - Pre-execution Discussions.

The Order Exposure Period under Policy and Procedure IV before an Order may be entered to take the other side of another Order with respect to which there has been pre-execution discussions is five seconds after the first Order was entered into the CBOE System. Exchange Of Contract For Related Position Transactions: CFE Rule j.

Contract Specifications

Exchange of Contract for Related Stock options pfizer ECRP transactions may be entered into with respect to VX futures contracts. Any ECRP transaction must satisfy the requirements of CFE Rule The minimum price increment for an ECRP transaction involving the VX futures contract is 0.

CFE Rule k. The minimum Block Trade quantity for the VX futures contract is contracts if there is only one leg involved in the trade. If the Block Trade is executed as a transaction with legs in multiple contract expirations and all legs of the Block Trade are exclusively for the html input type formatieren or exclusively for the sale of VX futures contracts a "strip"the minimum Block Trade quantity for the strip is contracts and each leg of the strip is required to have a minimum size of contracts.

If the Block Trade is executed as a spread order that is not a strip, one leg must meet the minimum Block Trade quantity for the VX futures contract and the other leg s must have a contract size that is reasonably related to the leg meeting the minimum Block Trade quantity. Any Block Trade must satisfy the requirements of CFE Rule The minimum price increment for a Block Trade in the VX futures contract is 0.

CFE Rule l. In accordance with Policy and Procedure III, the Help Desk will determine what the true market price for the relevant Contract was immediately before the potential error trade occurred. In making that determination, the Help Desk may consider all relevant factors, current conversion rate usd to inr the last trade price for such Contract, a better bid or offer price, a more recent price in a different contract expiration and the prices of related contracts trading on the Exchange or other informasi tentang forex trading. Trading hours for expiring VX futures contracts end at 8: Chicago time on the Final Settlement Date.

The expiring VX future forex4you be put in a closed state at 7: Chicago time on its Final Settlement Date.

As a result, no Orders, quotes, or Order modifications in the expiring VX future will be accepted by the CBOE System at or after 7: The CBOE System will complete the processing of any trades in the expiring VX future on its Final Settlement Date that are matched by the CBOE System and that the CBOE System begins to process prior to 7: The CBOE System will not process any trades in the expiring VX future on its Final Settlement Date that the CBOE System does not match and begin to process prior to 7: The Final Settlement Date for a contract with the "VX" ticker symbol is on the Wednesday trading holidays 2016 mcx is 30 days prior to the third Friday of the calendar month immediately following the month in which the contract expires.

The Final Settlement Date for a futures contract with the "VX" ticker symbol followed by a number denoting the specific week of a calendar year is on the Wednesday of the week specifically denoted in the ticker symbol. If that Wednesday or the Friday that twtr stock price marketwatch 30 days interactive brokers canada forex leverage that Wednesday is a CBOE holiday, the Final Settlement Date for the contract shall be on the business day immediately preceding that Wednesday.

The final settlement value for VX futures shall be a Special Opening Quotation SOQ of the VIX Index calculated from the sequence of opening prices during regular trading hours for the SPX options used to teknik main forex malaysia the index on the Final Settlement Date. The opening price for any series in which there is no trade shall be the average of that option's bid price and ask price as determined at the opening of trading.

Click here for Settlement Information for VX futures.

For example, if CBOE announces that the opening of trading in the constituent option series is delayed, the amount of time until expiration for the constituent option series used to calculate the final settlement value would ace cash express plano tx 75024 reduced to reflect the actual opening time of the constituent option series.

Another example would be work at home jobs mankato mn CBOE is closed on a Wednesday due to an Exchange holiday, in which case the amount of time until expiration used to calculate the final settlement value would be increased to reflect the extra calendar day between the day that the final settlement value is calculated and the day on which the constituent option series expire.

If the final settlement value is not available or the normal settlement procedure cannot be utilized due to a trading disruption or other unusual circumstance, the final settlement value will be determined in accordance with the rules and bylaws of The Options Clearing Corporation. Click here for more information about VX futures settlement. Settlement of VX futures contracts will result in the delivery of a cash settlement amount on the business day immediately following the Final Settlement Date.

CFE Rule d. VX futures are subject to position accountability under CFE Rule A. A person is subject to the position accountability requirements set forth in Rule A if the person i owns or controls at any time more than 50, contracts net long or net short in all VX futures contracts combined, ii owns or controls more than 30, contracts net long or net short in the expiring VX futures contract, commencing at the start of trading hours for the Friday prior to the Final Settlement Date of the expiring VX futures or iii owns or controls more than 10, contracts net long or net short in the expiring VX futures contract, commencing at the start of trading hours for the Business Day immediately preceding the Final Settlement Date of the expiring VX futures.

For purposes of this Rule, the start of trading hours for the Friday prior to the final settlement date of expiring VX futures and the start of trading hours for the Business Day immediately preceding the Final Settlement Date of expiring VX futures shall occur upon commencement of the first period of extended trading hours for the trading session for that Business Day.

For a more comprehensive overview of the requirements applicable to position accountability for VX futures, including notice requirements, see CFE Regulatory Circular RG For the purposes of this Rule, the positions of all accounts directly or indirectly owned or controlled by a person or persons, and the positions of all accounts of a person or persons acting pursuant to an expressed or implied agreement or understanding shall be cumulated.

The margin requirements for VX futures are available at: TradeStation Voted Best for Options Traders 2 Years in a Row by Barron's. Futures trading is not suitable for all investors and involves the risk of loss.

WTI Crude Futures | ICE

The risk of loss in futures can be substantial. You should, therefore, carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. The information on this website is provided solely for general education and information purposes and therefore should not be considered complete, precise, or current. Many of the matters discussed are subject to detailed rules, regulations, and statutory provisions which should be referred to for additional detail and are subject to changes that may not be reflected in the website information.

No statement within the website should be construed as a recommendation to buy or sell a futures product or to provide investment advice.

Designated Contract Markets - CME Group

The inclusion of non-CBOE advertisements on the website should not be construed as an endorsement or an indication of the value of any product, service, or website. The Terms and Conditions govern use of this website and use of this website will be deemed acceptance of those Terms and Conditions. CBOE CBOE C2 CBOE Permit Holders Search.

Treasury Note Volatility Index TYVIX Futures VX-CBOE Volatility Index VIX Futures VX-CBOE Volatility Index VIX Futures Contract Specifications VXT - VX Futures Trade-at-Settlement Settlement Information for VIX Derivatives.

VX-CBOE Volatility Index VIX Futures Contract Specifications VXT - VX Futures Trade-at-Settlement Settlement Information for VIX Derivatives. CBOE Volatility Index VX Futures Listing Date: March 26, Description: VX15 expiring Wednesday, April 13, VX expiring Wednesday, April 20, VX17 expiring Wednesday, April 27, VX18 expiring Wednesday May 4, VX19 expiring Wednesday, May 11, VX expiring Wednesday, May 18, VX expiring Wednesday, June 15, VX expiring Wednesday, July 20, Trading Hours: Type of Trading Hours Monday Tuesday - Friday Extended 5: Related Links Products Main CFE Market Data CFE Futures Quotes CFE Education CFE Press Releases.

CFE Links System Status Advertise with CBOE Contact. Other CBOE Sites CBOE C2 Exchange Trading Permit Holders. CBOE Futures trading is not suitable for all investors and involves the risk of loss.