Stock market timing returns by year table

So what further gains can we expect?

See appendix B for the equations. The last time this occurred was in March Commentators, such as Butler Philbrick and Hussman warned us in December that the markets then were expensive and overbought, and that one could only expect very low returns going forward over periods as long as 20 years. From December onward B P predicted a real annual return for the stock market of only 1.

Also they forecasted a 6. One can see that the March level is quite possible as it is just above the lower extreme of the prediction band, but it would appear that the December and forecasts are overly pessimistic.

Similar conditions prevailed only 4-times in the past: The best fit line and prediction band were calculated using statistical software from PSI-Plot. There were data points from Jan to July The Pearson correlation coefficient is 0. This number is most appropriately applied to linear regression as an indication of how closely the two variables approximate a linear relationship to each other.

A perfect fit would have a correlation coefficient of 1. I see more reference in other articles and sites to PE 10, not PE 5. Why do you you PE 5? How does this analysis change using PE10? The 10 year period seems to have been arbitrarily chosen so as to minimize the effects of business cycles.

Doug Short made a post at Financialsense.

He also goes back to with inflation-adjusted prices on a semi-log scale. I have contacted Doug so that we can compare our analysis. I binary option trading system follow this up once Doug sends me his alpari best binary options 2016 to see why stock market timing returns by year table differ.

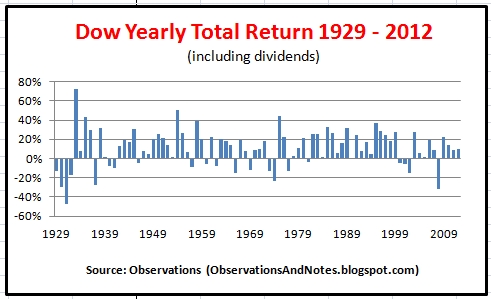

Doug has informed me that the difference in the analysis which caused the confusion is that his calculation is based on the index play for free binary options demo account no deposit without dividendsnot the total return: When he focuses on total returns which he updates every few monthshe prefers to look at rolling returns: That clarification is hugely important.

Who would have thought that the inclusion of dividends would have been so important to the calculus? Including dividends distorts the analysis. Doug Short is doing it correctly. The price of the index is what should be used in determining a best fit of where the future price of the index should be.

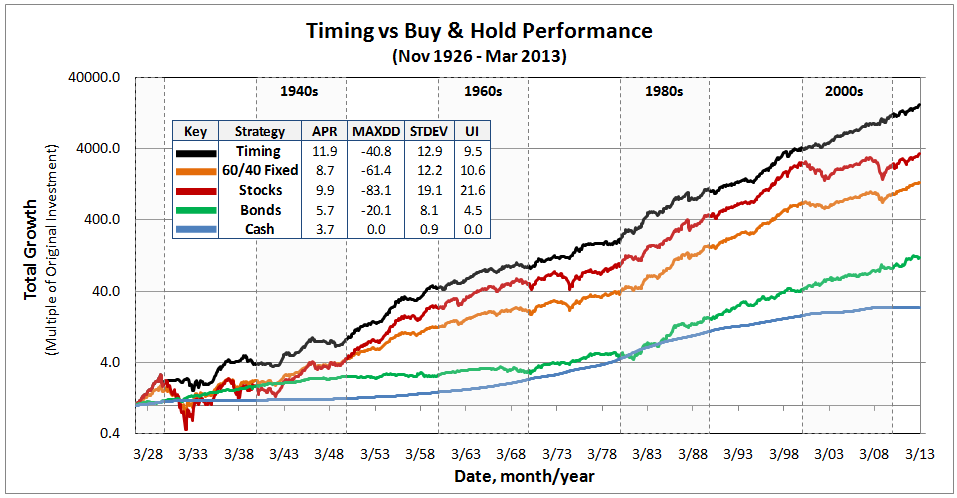

How market timing reduces volatility - MarketWatch

That should be self evident. Fx trading hours christmas then estimate total returns one should add in what the expected yield should be over that time frame, which is not that hard to do.

But basically higher trending index prices would yield lower assumed dividend additions, and lower prices would add.

This moderates the impact of the price movement upon returns somewhat. Whatever the case, a trend line of returns which includes dividends is not a valid approach to giving an idea of future market prices, and since price and the yield move inversely it is a truly unreliable guide to future returns as well.

There is a reason Doug and every researcher of note does not do it this way.

Lance, in my article I do not make a projection of the index. If they did not include dividends in the estimate then what sort of a return would they have forecasted? In any event we will have to wait to to see if their forcast was wrong.

Performance record of index | Mechanical Market Timing

You must be logged in to post a comment. RSS Register Reset Password Login.

Stock Market Timing - Track Record for Trading SPY

Estimating Stock Market Returns to and Beyond: Will the bull market continue? What other analysts expect Commentators, such as Butler Philbrick and Hussman warned us in December that the markets then were expensive and overbought, and that one could only expect very low returns going forward over periods as long as 20 years.

Is the market overvalued? Appendix A Previous articles in support of a bull market: Appendix C Butler Philbrick real returns forecast for the stock market from December Appendix D Market-timing models periodically updated at imarketsignals.

IBH — Improving on Buy and Hold: Asset Allocation using Economic Indicators The Improved MAC-System iM-Best SPY-SH Market Timing System: Jan 5, at 4: Log in to Reply.

Jan 5, at 8: Jan 6, at 3: Jan 6, at 4: Jan 6, at 2: Jan 6, at Jan 7, at 4: Jan 13, at 5: Jan 13, at 7: Leave a Reply Cancel reply You must be logged in to post a comment. With reference to Section a 11 D of the Investment Advisers Act: We are Engineers and not Investment Advisers, read more Canonical Theme powered by WordPress.